https://gic.org/wp-content/uploads/2024/03/Ortho-SanClemente-CA-33.429051-117.600331.png

576

1024

Angie Brewster

https://gic.org/wp-content/uploads/2021/01/GIC-logo.png

Angie Brewster2024-03-08 10:32:322024-03-12 12:54:50Expanding Coverage in the U.S. in 2024

https://gic.org/wp-content/uploads/2024/03/Ortho-SanClemente-CA-33.429051-117.600331.png

576

1024

Angie Brewster

https://gic.org/wp-content/uploads/2021/01/GIC-logo.png

Angie Brewster2024-03-08 10:32:322024-03-12 12:54:50Expanding Coverage in the U.S. in 2024Aerial Imagery & Property Analytics

Providing location insights to the insurance industry

A member consortium. Insurer-driven. At cost.

Insurers need up-to-date aerial imagery and geospatial information that is comprehensive and precise. The GIC offers a competitive edge to insurers to enhance their policy workflows, from beginning to end.

30+ Countries

Insurers can leverage aerial imagery and geospatial data in 30+ countries, including U.S., U.K., Japan, Australia, Canada, Germany, and more.

Consistent & Accurate

Captured with calibrated sensors and positioned with ground survey points, our professional-grade imagery is unmatched in accuracy and quality.

End-To-End Technology

From market-leading cameras to aerial captures and large-scale data processing, nobody tracks every pixel better than our operations partner Vexcel.

Blue Sky Imagery

Get access to a current (and historic) library of stunningly clear imagery in 25+ countries, including U.S., Canada, UK, Germany, France, Italy, Japan, and Australia.

Gray Sky Imagery

When major disaster strikes, insurers need rapid access to high-resolution aerial location data. Our Gray Sky program is the most comprehensive, post-catastrophic imagery service available. And, members can access imagery within 24 hours of aircraft collection.

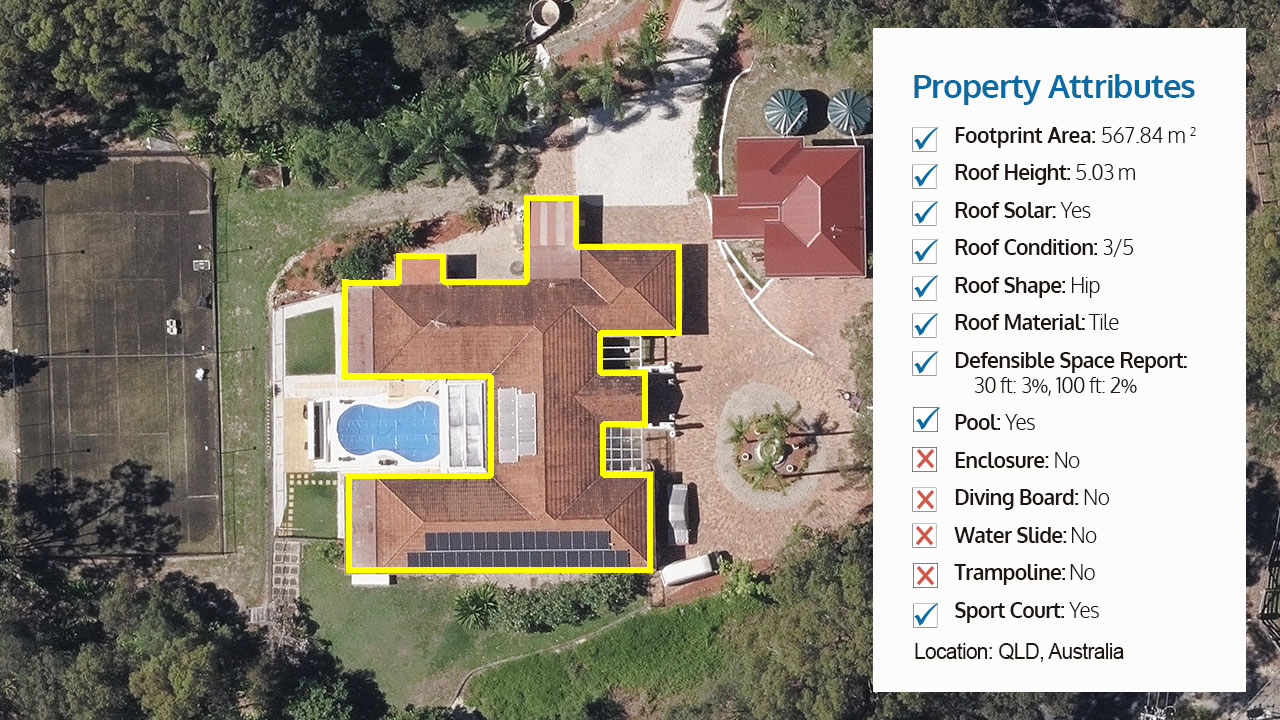

Elements

Instantly build your knowledge of a property and building using Elements, the fastest way to get reliable and detailed attributes derived from our aerial imagery.

Easy Integration & APIs

Integrate the powerful image library and geospatial data into your workflows. Access the information you need in your preferred third-party application—all through APIs.

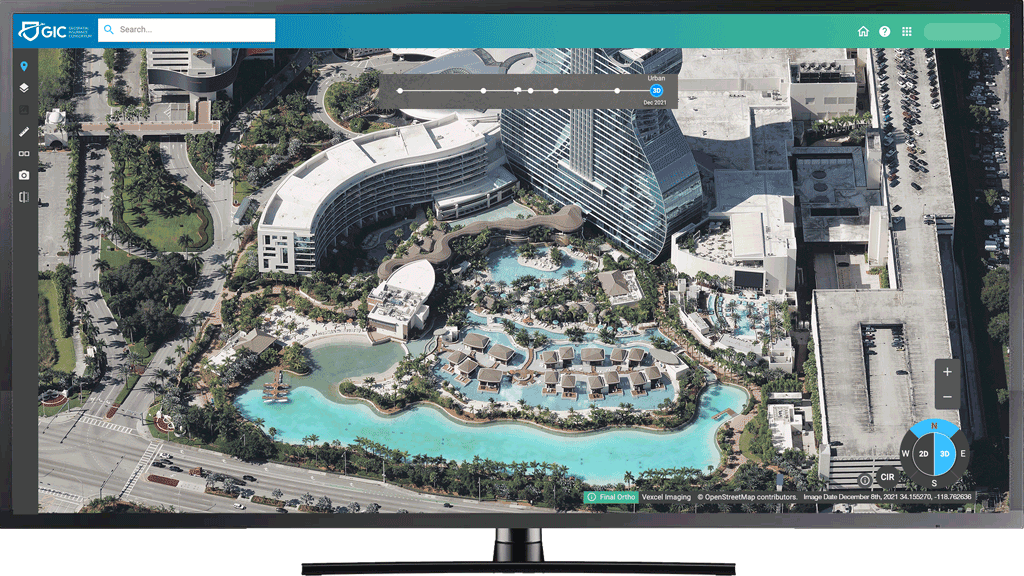

Access Imagery Anywhere

You need a better way to visualize data. Access to the cloud-based Viewer App lets you quickly analyze your area of interest—all you need is an address or lat/long.

What our members are saying…

Request A Demo

Unlock more insights for insurance.